A recent report on the Future of Retirement conducted by HSBC found two interesting points about Australians:

- We worry more about our super than any other nation, yet…

- We take less action to plan for our financial futures.

As a Certified Financial Planner, naturally, I’m concerned about this finding. It’s also a far cry from our international reputation as ‘laid back’ Aussies. It seems this ‘she’ll be right, mate’ type of attitude may mask our deeper financial fears that lie just below the surface.

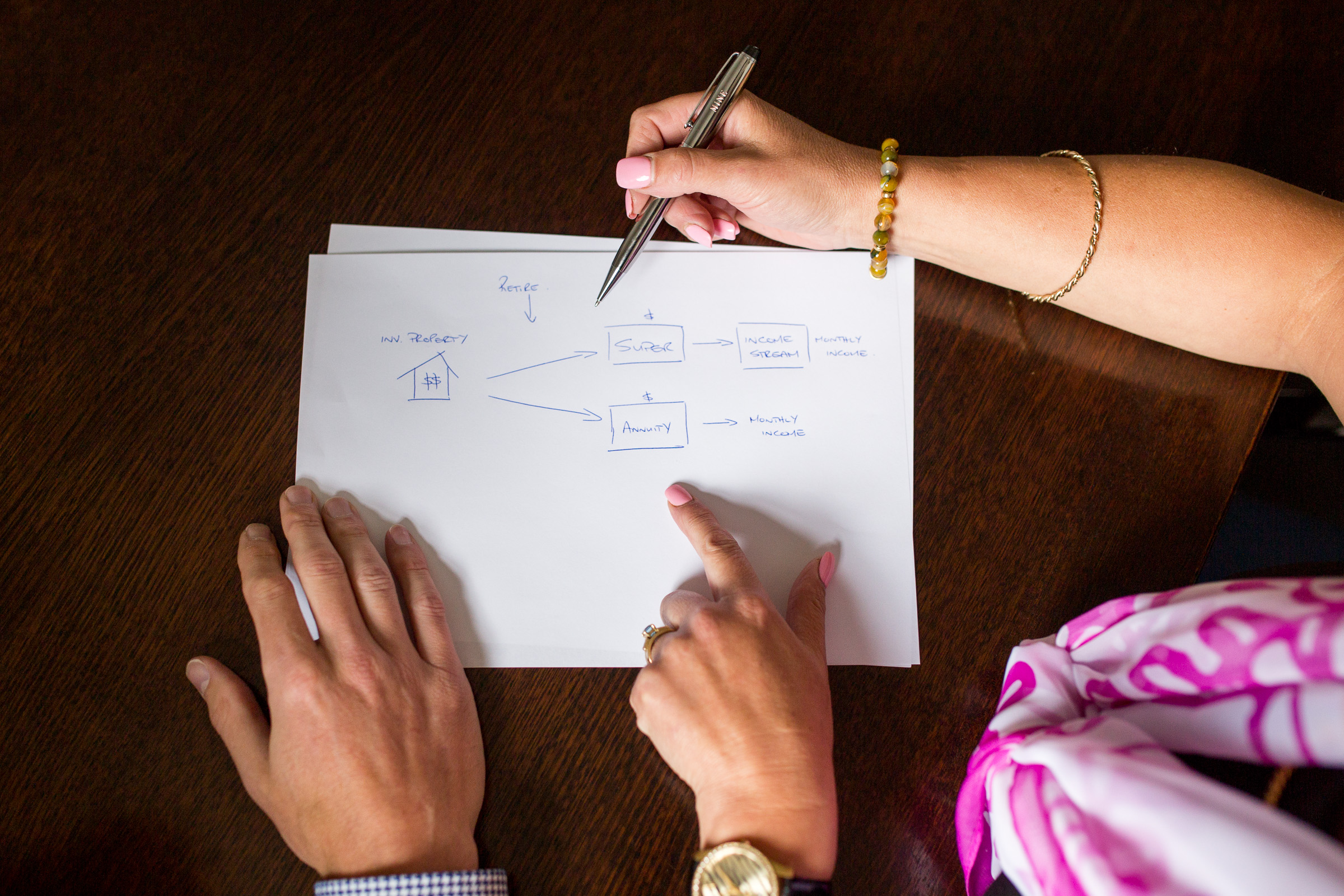

While our employers pay our super for our working lives, it’s when we head into retirement that super kicks into reverse. The more super we have accrued means the longer it’ll last to support a comfortable lifestyle. Our super will determine how many holidays we can enjoy in our later years. How well we can spend our kids’ inheritance or how well we easefully and quickly we can relax into retirement.

Super is worth taking seriously.

If you’re like the majority of Australians who worry about super, yet aren’t doing anything to alleviate that worry, why is that?

Perhaps super feels beyond your control. Perhaps it feels too far away. Perhaps you don’t know where to start or feel overwhelmed by conflicting points of view.

The truth is: you have more power than you think.

No matter what you earn; whether you’re an employee or self-employed business owner, you can create a powerful plan that will yield the best super results for your situation.

Imagine feeling secure, in control and at peace with regard to your super. Most of our worries are about the future, which means planning for a comfortable future, will help you sleep easy at night.

To help you plan for retirement – effectively – seek professional support. Here at Financial Aspects, we help people manage their superannuation and plan for retirement everyday. Call us to arrange a consultation at a time that suits your schedule.