Listening to the news and reading the papers can scare investors into making rash decisions. So how can you navigate falling markets and market volatility?

The financial press worked itself into a frenzy last week as the benchmark S&P 500 in the US briefly reached a 20% fall from its recent high in January. The Australian market has been a little better, falling 8.3% from its more recent high. The difference is mostly due to the relative lack of tech companies here in Australia.

When investors see red across their portfolios, the emotions this can trigger often lead to poor decisions. So, here’s a short guide to navigating market volatility.

Part 1: Before the downturn

My clients all have a Statement of Advice which was completed during times when markets were more calm, and for investors that usually means ‘going up’. It is this document which details your long-term plans.

For accumulators these plans may be different from my retiree clients, but the sentiment is the same – we have invested funds for the long-term and there will inevitably be periods of negative performance. I say again, there will be periods of negative performance on a regular basis as soon as you move from cash to any other asset class. Even cash isn’t shielded from going backwards. With inflation running at over 5% per annum in Australia at the moment, and the big four banks offering 12 month term deposit rates of 0.60% per annum at time of writing, your cash is losing purchasing power of at least 4.4% per annum if you chose those term deposits!

So what to do? Whether you’re an accumulator or a retiree the approach is the same – stick to your plan.

Part 2: When markets head south

All market downturns are slightly different. This time both the growth and defensive parts of portfolios have headed in the same direction, down. This is not usually the case but has been the consequence of historic low interest rates. When interest rate expectations rise, bonds tend to fall in value. Unfortunately this has happened at a time when equities could have done with a hand up from their bond friends.

When market volatility eventuates, emotions will quickly become elevated. The first thing to do is stay calm.

The next thing to do is to review that plan you have (your Statement of Advice). Now comes the hard part – following through and sticking to the plan. As Mike Tyson famously said, “everyone has a plan until they get punched in the mouth.” For investors, a market downturn is a bit like getting punched in the mouth. What seemed like a good idea in the calm of a bull market, might suddenly seem folly when markets are in freefall. But that’s why we plan and write things down, because making decisions like these in the heat of the moment is a recipe for failure.

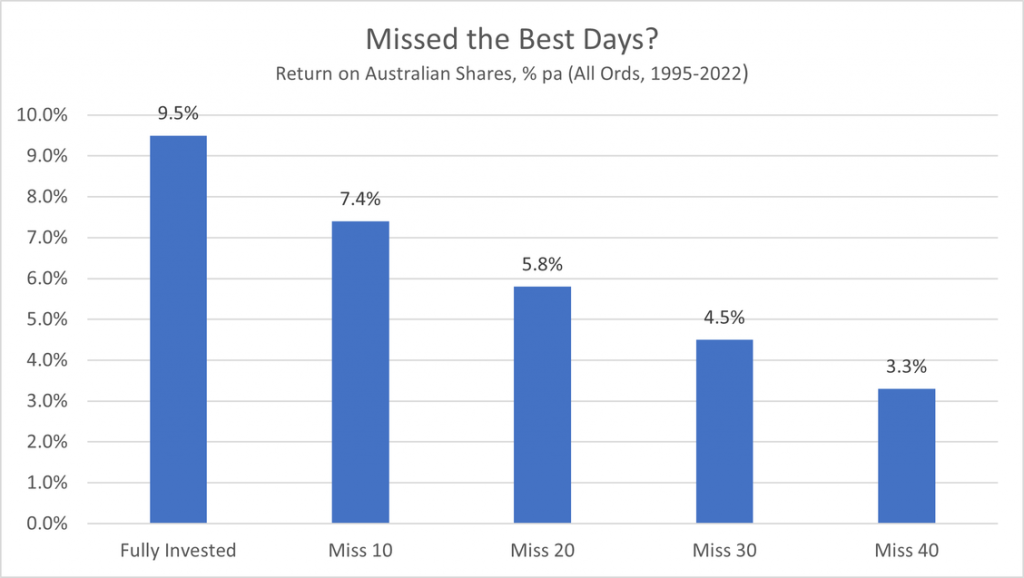

Selling at a low point in markets can crystallise an actual loss of capital. Doing so ensures you’ll never get this back. What about re-entering the market, Dan? I can do that. Of course you can, but can you pick the bottom? By the time you calm your nerves and reenter the markets you will have most likely missed a good part of the recovery, if not all. What effect can that have on long-term performance?

Key message: market timing is great if you can get it right, but without a process the risk of getting it wrong is very high and, if so, it can destroy your longer-term returns.

The grind higher

Markets can sometimes fall very quickly, before recovering slowly. Or as it’s more commonly described among investors: markets go down the elevator and up the escalator.

Remember March 2020? The Australian share market fell by 36% in that month! It then recovered all of those losses and is 1,800 points higher than the March 2020 bottom at time of writing.

Let’s look at that and some other examples of market downturns to see how they’ve panned out:

As said previously, each market downturn or bout of market volatility is different and the lengths of time of the downturn and subsequent recoveries are different too. However, investment markets have been doing this for many, many years and they will continue to do so. Having a long-term plan, and importantly, sticking to it, is your way out of these downturns.

If you stick to your plan, you’ll likely do better than most. And hopefully you don’t lose too much sleep along the way.

Don’t lose that plan though. You’ll need it again someday.

If you have any questions regarding the content in this email, or would like to discuss this or your portfolio in more detail, feel free to give me a call on 03 5227 7777.